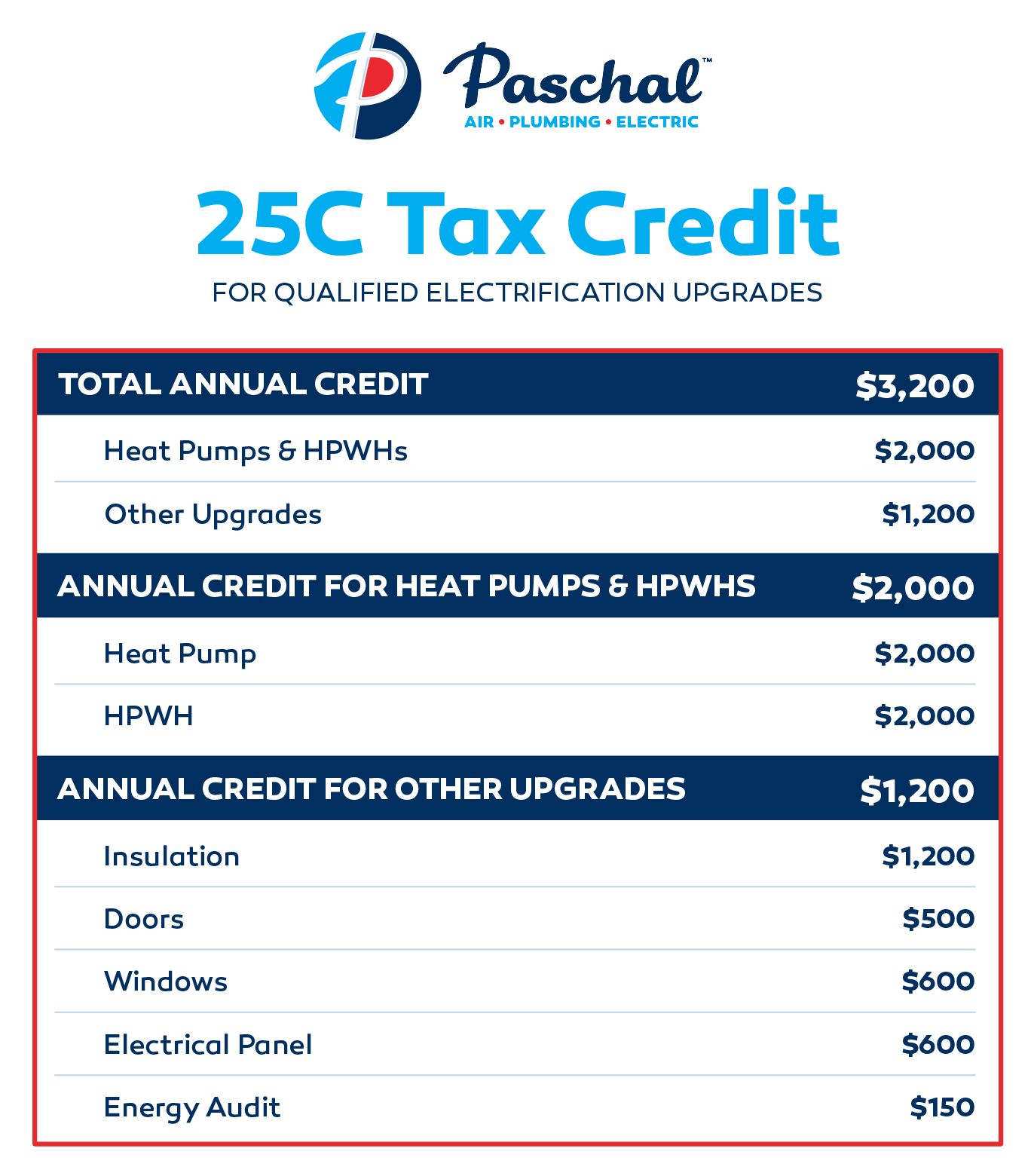

Does Heat Pump Qualify For Tax Credit . For the tax credit program, the new incentives will apply to equipment installed on. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. air source heat pumps tax credit. This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. Any taxpayer would qualify for the federal tax credits. 1, 2023, may qualify for a tax. In 2023, the maximum federal tax credit for. 2023 through 2032: who qualifies for a heat pump tax credit or rebate. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind.

from fabalabse.com

30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. 2023 through 2032: who qualifies for a heat pump tax credit or rebate. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. For the tax credit program, the new incentives will apply to equipment installed on. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. air source heat pumps tax credit. 1, 2023, may qualify for a tax. In 2023, the maximum federal tax credit for. Any taxpayer would qualify for the federal tax credits.

How do I know if I am eligible for energy rebate? Leia aqui What

Does Heat Pump Qualify For Tax Credit This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. air source heat pumps tax credit. 1, 2023, may qualify for a tax. Any taxpayer would qualify for the federal tax credits. who qualifies for a heat pump tax credit or rebate. In 2023, the maximum federal tax credit for. 2023 through 2032: For the tax credit program, the new incentives will apply to equipment installed on. This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind.

From www.youtube.com

Tax credits offered for heat pump installation YouTube Does Heat Pump Qualify For Tax Credit 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. 1, 2023, may qualify for a tax. who qualifies for a heat pump tax credit or rebate. In 2023, the maximum federal tax credit for. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to. Does Heat Pump Qualify For Tax Credit.

From www.cloverco.com

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting Does Heat Pump Qualify For Tax Credit In 2023, the maximum federal tax credit for. 1, 2023, may qualify for a tax. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. This tax credit is effective for products purchased and installed. Does Heat Pump Qualify For Tax Credit.

From www.quitcarbon.com

How to Use 2023's New Heat Pump Tax Credits Does Heat Pump Qualify For Tax Credit 1, 2023, may qualify for a tax. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. For the tax credit program, the new incentives will apply to equipment installed on. 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual.. Does Heat Pump Qualify For Tax Credit.

From lilithwkylie.pages.dev

Tax Credit For New Water Heater 2024 Mufi Tabina Does Heat Pump Qualify For Tax Credit For the tax credit program, the new incentives will apply to equipment installed on. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. air source heat pumps tax credit. 2023 through 2032: under the consolidated appropriations act of 2021, the renewable energy tax credits for. Does Heat Pump Qualify For Tax Credit.

From www.pumprebate.com

Tax Rebates For Heat Pumps 2022 Does Heat Pump Qualify For Tax Credit For the tax credit program, the new incentives will apply to equipment installed on. 1, 2023, may qualify for a tax. Any taxpayer would qualify for the federal tax credits. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. under the consolidated appropriations act of 2021, the. Does Heat Pump Qualify For Tax Credit.

From servicechampions.com

Service Champions Heat Pump Tax Credits Does Heat Pump Qualify For Tax Credit For the tax credit program, the new incentives will apply to equipment installed on. In 2023, the maximum federal tax credit for. 2023 through 2032: Any taxpayer would qualify for the federal tax credits. who qualifies for a heat pump tax credit or rebate. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have. Does Heat Pump Qualify For Tax Credit.

From cornieqmartelle.pages.dev

New Energy Tax Credits For 2024 Jere Robina Does Heat Pump Qualify For Tax Credit 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. air source heat pumps tax credit. This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. 2023 through 2032: the 25c tax credit allows taxpayers to claim certain home energy upgrades, like. Does Heat Pump Qualify For Tax Credit.

From www.afterhours-hvac.com

2023 Federal Tax Credit for Heat Pumps After Hours Heating and Air Does Heat Pump Qualify For Tax Credit 1, 2023, may qualify for a tax. This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass. Does Heat Pump Qualify For Tax Credit.

From www.pumprebate.com

Heat Pump Energy Tax Credit Does Heat Pump Qualify For Tax Credit the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. 1, 2023, may qualify for a tax. who qualifies for a heat pump tax credit or rebate. 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual.. Does Heat Pump Qualify For Tax Credit.

From environmentamerica.org

Heat pumps how federal tax credits can help you get one Does Heat Pump Qualify For Tax Credit This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. 2023 through 2032: In 2023, the maximum federal tax credit for. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. under the consolidated appropriations act of 2021, the. Does Heat Pump Qualify For Tax Credit.

From www.techwalls.com

Do MRCOOL DIY Ductless MiniSplit Heat Pumps Qualify for the 30 Does Heat Pump Qualify For Tax Credit 2023 through 2032: In 2023, the maximum federal tax credit for. For the tax credit program, the new incentives will apply to equipment installed on. Any taxpayer would qualify for the federal tax credits. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. 1, 2023, may qualify for a tax. This. Does Heat Pump Qualify For Tax Credit.

From www.rescueairtx.com

What You Need to Know About the Federal Tax Credit for Heat Pumps in 2023 Does Heat Pump Qualify For Tax Credit air source heat pumps tax credit. 1, 2023, may qualify for a tax. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. Any taxpayer would qualify for the federal tax credits. This tax. Does Heat Pump Qualify For Tax Credit.

From symbiontservice.com

30 Federal Tax Credit on GeoThermal Heat Pumps Symbiont Service Does Heat Pump Qualify For Tax Credit 2023 through 2032: 1, 2023, may qualify for a tax. For the tax credit program, the new incentives will apply to equipment installed on. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to. Does Heat Pump Qualify For Tax Credit.

From homes.rewiringamerica.org

25C Electrical Panel Tax Credits A Guide for Homeowners Does Heat Pump Qualify For Tax Credit In 2023, the maximum federal tax credit for. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. Any taxpayer would qualify for the federal tax credits. 1, 2023, may qualify for a tax. This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032.. Does Heat Pump Qualify For Tax Credit.

From www.youtube.com

Tax credits offered for heat pump installation YouTube Does Heat Pump Qualify For Tax Credit This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. the 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. air source heat pumps tax credit. 1, 2023, may qualify for a tax. In 2023, the maximum federal tax credit. Does Heat Pump Qualify For Tax Credit.

From dcmdva.sila.com

25C Tax Credit Sila Heating Cooling Plumbing DC / MD / VA Does Heat Pump Qualify For Tax Credit Any taxpayer would qualify for the federal tax credits. under the consolidated appropriations act of 2021, the renewable energy tax credits for fuel cells, small wind. For the tax credit program, the new incentives will apply to equipment installed on. who qualifies for a heat pump tax credit or rebate. air source heat pumps tax credit. . Does Heat Pump Qualify For Tax Credit.

From www.scottcomfortsystems.com

How to Choose a Heat Pump in Raleigh Federal Tax Credits Available Does Heat Pump Qualify For Tax Credit air source heat pumps tax credit. This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. who qualifies for a heat pump tax credit or rebate. For the tax credit program, the new incentives will apply to equipment installed on. In 2023, the maximum federal tax credit for. 2023. Does Heat Pump Qualify For Tax Credit.

From www.myqualitycomfort.com

Federal Tax Credits for Heating and Air Conditioning Does Heat Pump Qualify For Tax Credit This tax credit is effective for products purchased and installed between january 1, 2023, and december 31, 2032. 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual. For the tax credit program, the new incentives will apply to equipment installed on. Any taxpayer would qualify for the federal tax credits. the. Does Heat Pump Qualify For Tax Credit.